14 April 2025

A guide to employer and employee social contributions in Switzerland

Understanding Swiss social contributions is vital for any business that employs people in Switzerland. With its intricate structure of mandatory systems like AHV/AVS, ALV/AC, and BVG/LPP, learning the Swiss social security landscape requires careful attention to compliance and reporting.

This guide explains what contributions are required, how they’re shared between employers and employees, and how businesses can simplify compliance through a Swiss Employer of Record (EOR).

Overview of the Swiss social security system

Switzerland’s social security system is built on a federal framework with cantonal variations, ensuring comprehensive coverage for old-age pensions, disability benefits, accident insurance, and unemployment protection. Contributions are compulsory for most employees and must be handled correctly to avoid penalties.

Core social contribution schemes:

- AHV/AVS (old-age and survivors insurance): Provides pensions to retirees and support for survivors of deceased individuals.

- IV (Disability insurance): Offers income replacement for those who can no longer work due to disability.

- EO (loss of earnings): Covers income loss for maternity, paternity, military service, and other situations.

- ALV/AC (unemployment insurance): Helps workers who lose their jobs transition back into the workforce.

- BVG/LPP (occupational pension): Provides additional retirement savings through mandatory employer-sponsored pension plans.

Who is covered:

- Employees: Contributions are automatically deducted from payroll, with employers matching or contributing a portion.

- Self-employed individuals: Must pay both employer and employee shares themselves.

- Foreign workers: Must be integrated into the Swiss system if they have employment contracts under Swiss law.

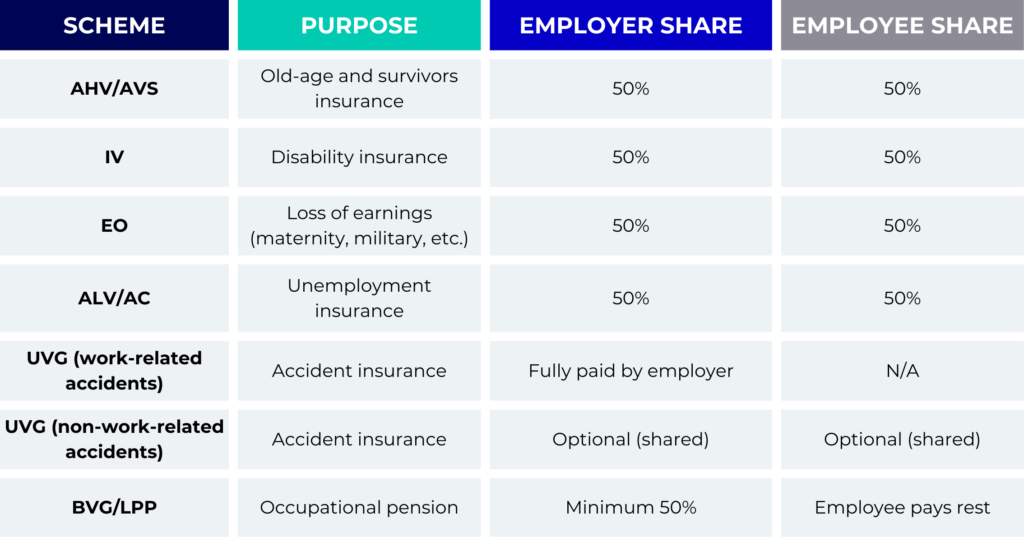

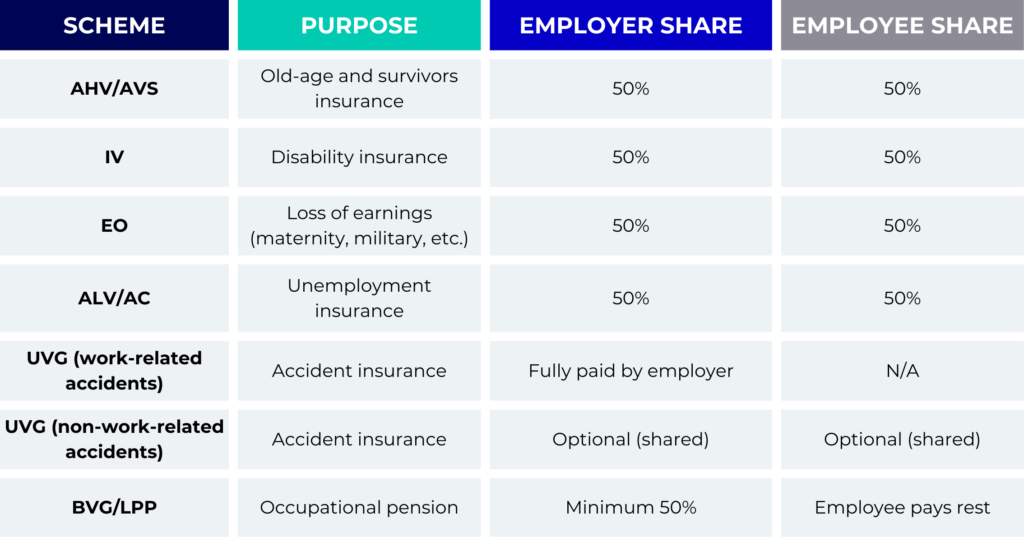

Employer and employee contribution breakdown

Employers and employees share responsibility for contributing to the various schemes. The breakdown is typically 50/50, but some schemes, such as occupational pensions (BVG/LPP), require the employer to cover at least half. Here’s how contributions typically look:

Contribution summary:

- AHV/AVS: Typically 10.6% of gross salary, split equally.

- ALV/AC: Usually 2.2%, divided evenly.

BVG/LPP: Rates vary, starting around 7–18% based on employee age and salary, with the employer covering at least half.

Occupational pensions (BVG/LPP): how they work

Occupational pensions under the BVG/LPP system are mandatory for employees earning above a certain threshold. The minimum coordinated salary for pension coverage is set by federal law, ensuring all eligible workers have access to supplementary retirement savings.

- Eligibility: Employees earning more than CHF 22,050 annually (2024 figure) must be enrolled.

- Minimum contributions: Employers must cover at least 50% of contributions. The total contribution rate increases with the employee’s age, reflecting the need for higher savings as retirement approaches.

- Mandatory vs. extra-mandatory: While mandatory contributions cover earnings up to a certain limit (e.g., CHF 88,200), employers can choose to provide additional coverage on earnings above this threshold.

Employers should account for BVG/LPP contributions as part of their overall labour costs, separate from social security contributions. Proper budgeting ensures no surprises when payroll runs are due.

Compliance obligations for employers

Employers are responsible for ensuring all contributions are accurately calculated, deducted, and paid on time. Key compliance steps include:

- Registration with compensation offices: Employers must register with a compensation office (AHV/AVS fund) to set up their payroll system.

- Monthly deductions and payments: Social security contributions must be deducted each pay period and submitted to the relevant authorities. Employer contributions, often paid alongside employee deductions, must be remitted on a monthly or quarterly basis depending on the agreement with the compensation office.

- Annual reporting and statements: Employers provide employees with year-end statements showing their contributions. This transparency ensures that employees understand their benefits and tax obligations.

- Avoiding penalties: Late or incorrect submissions can result in fines, back payments, and potential audits. Employers must maintain accurate records and stay updated on any changes in contribution rates or compliance requirements.

How a Swiss Employer of Record can ensure compliance

Learning these obligations can be overwhelming for companies without a Swiss legal entity. A Swiss Employer of Record (EOR) simplifies the process by taking on all compliance responsibilities, including social contributions, tax deductions, and payroll management.

Key benefits of an EOR:

- The EOR handles all registration, deductions, and payments, ensuring contributions meet federal and cantonal requirements.

- They also stay up-to-date on regulatory changes, ensuring your payroll remains compliant.

- Payroll runs smoothly without needing in-house expertise. The EOR acts as the legal employer in Switzerland, reducing administrative complexity.

- Instead of setting up a Swiss entity, which can take months and involve significant costs, an EOR allows businesses to hire locally and start paying workers within days.

- This approach eliminates the need to manage multiple vendor relationships or learn Swiss payroll regulations from scratch.

- The EOR shields businesses from penalties, audits, reputational damage and other risks by ensuring accurate contributions and compliance.

For example, a UK-based tech firm was eager to hire skilled talent in Switzerland but faced a maze of social contribution rules, from AHV to BVG. With no local entity, they struggled to ensure compliance and proper payroll deductions. Partnering with a Swiss Employer of Record changed everything. The EOR seamlessly handled registrations, calculated contributions, and provided timely reporting. As a result, the company remained compliant, avoided costly penalties, and focused on their growth while leaving social contribution headaches behind.

When to consider an EOR:

- Expanding a small team or hiring a few remote workers.

- Testing the Swiss market before establishing a permanent entity.

- Ensuring compliance when scaling up operations quickly.

- Accessing local expertise without adding in-house administrative burden.

Social contributions explained

Understanding Switzerland’s employer and employee social contributions is essential for compliant payroll operations. With its complex structure of AHV/AVS, ALV/AC, BVG/LPP, and other contributions, businesses must carefully manage calculations, deductions, and payments to maintain legal and financial stability.

Partnering with a Swiss Employer of Record for companies without a Swiss legal entity offers an efficient and compliant solution. An EOR can handle all aspects of social contributions, payroll, and compliance, ensuring businesses can focus on growth rather than administrative challenges. Contact us today to learn how a Swiss EOR can simplify your payroll processes and ensure workforce compliance.

Read more

How to manage payroll for employees and freelancer workers in Switzerland

Employer of Record vs. legal entity in Switzerland: which is better for your business?

Cross-border work in Switzerland: How to live in France, Germany, or Italy while working in Switzerland

Contact us

Contact our local expert for tailored guidance on Swiss employment solutions.