10 April 2025

Employer of Record vs. legal entity in Switzerland: which is better for your business?

Switzerland consistently ranks as one of the world’s most business-friendly countries. With its stable economy, highly skilled workforce, and transparent regulatory environment, it’s no wonder that international businesses see Switzerland as a prime destination for expansion. However, the process can be complex for companies looking to hire employees and establish operations here. The complexities of Swiss corporate structures, compliance with local labour laws, and learning tax regulations often present significant hurdles.

When entering the Swiss market, organisations must decide how best to structure their presence. Two common options are setting up a legal entity, such as a subsidiary or branch, or partnering with a Swiss Employer of Record (EOR). Each approach has its own set of advantages and challenges, and the choice you make can have a lasting impact on your company’s operational efficiency, legal compliance, and financial performance.

This article’ll explore both options in depth, comparing the legal, tax, and administrative requirements for establishing a legal entity versus working with an EOR. By the end, you’ll better understand which route best aligns with your expansion strategy and business goals.

What is an Employer of Record in Switzerland?

An Employer of Record is a third-party service provider that legally employs workers on behalf of foreign companies. While your business retains full operational control, the EOR takes care of the administrative and legal responsibilities that come with employment. This includes drafting employment contracts compliant with Swiss labour laws, managing payroll and social security contributions, handling tax filings, and ensuring all employee-related regulations are met.

In essence, the EOR serves as the legal employer, allowing your company to hire and pay employees in Switzerland without establishing a legal entity. This model is particularly useful for businesses that want to enter the market quickly, test its potential, or hire remote staff without the incorporation complexity.

What does it mean to set up a legal entity in Switzerland?

Setting up a legal entity in Switzerland involves registering a local business structure—most commonly a GmbH (Gesellschaft mit beschränkter Haftung, or limited liability company), AG (Aktiengesellschaft, or corporation), or branch office. Each type of entity has its own registration requirements, tax implications, and compliance obligations.

The process typically involves securing a local office address, appointing a Swiss-based director or representative, opening a Swiss bank account, and registering the company with the Swiss Commercial Register.

Depending on the type of entity and the company’s readiness, this can take several weeks to months. Once established, the legal entity is fully responsible for all business operations, tax filings, and compliance with Swiss labour and employment laws.

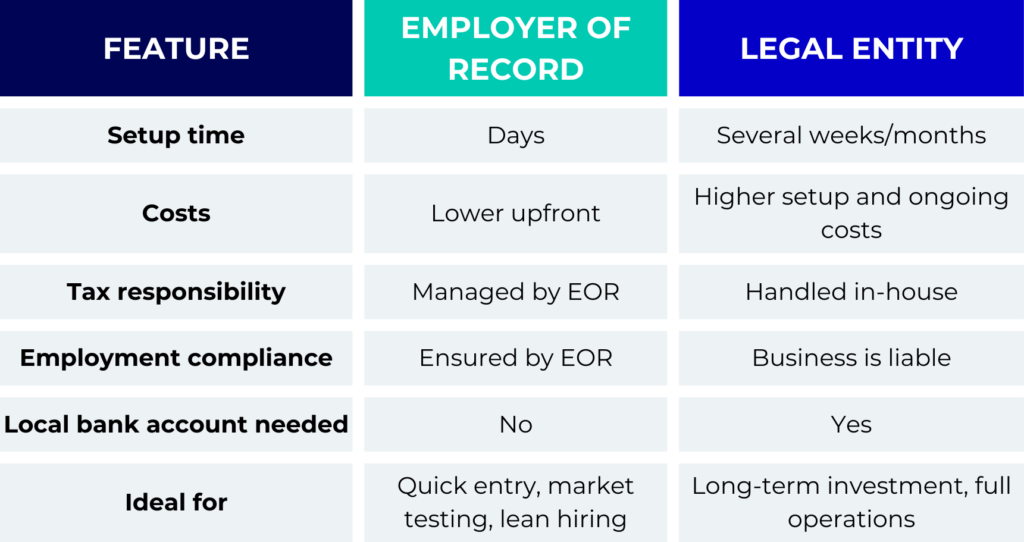

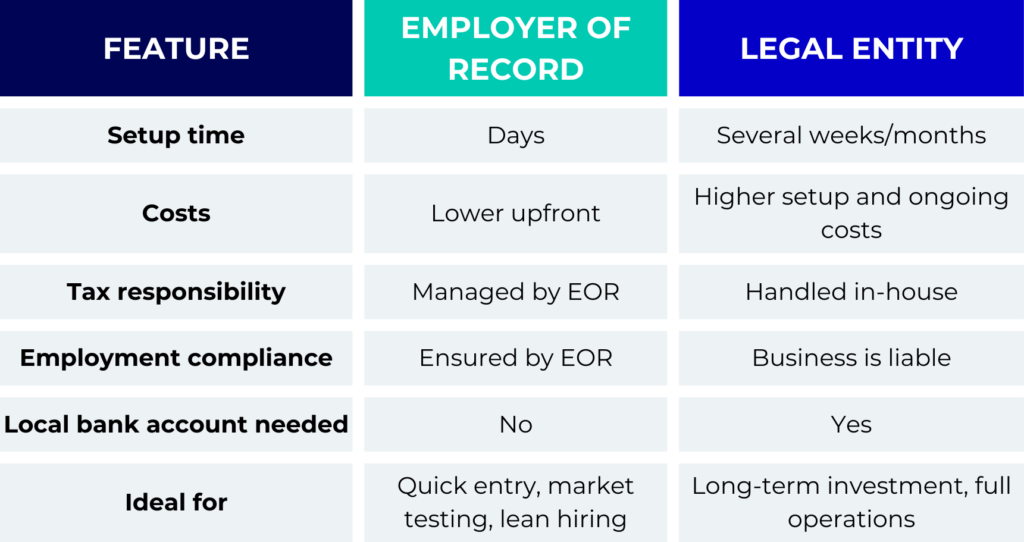

Employer of Record vs. legal entity: key differences

When should you use an Employer of Record in Switzerland?

An EOR is often the best choice for businesses looking to enter Switzerland quickly and with minimal risk. It’s particularly advantageous in scenarios such as:

- Hiring without a local entity: If your company wants to hire a few employees or contractors in Switzerland but doesn’t want the financial and administrative burden of setting up a local entity, an EOR provides a compliant, hassle-free solution.

- Testing the market: If your company is uncertain about long-term prospects in Switzerland, an EOR lets you test the market by hiring a small team without making a permanent commitment.

- Distributed workforce needs: For businesses hiring remote or distributed employees in Switzerland, an EOR ensures these workers are fully compliant with local labour laws, social security, and tax regulations.

- Avoiding local compliance complexities: An EOR handles all employment-related compliance issues, from tax filings to benefits administration, so your company can focus on core business activities.

For example, a Ukrainian entrepreneur, Anna, wanted to expand her business into Switzerland to tap into the local market’s high demand for her IT software development services. However, she was hesitant to set up a full legal entity due to the significant cost and administrative complexity. Anna decided to work with a Swiss Employer of Record instead.

By partnering with an EOR, Anna was able to legally hire local consultants without establishing a company in Switzerland. The EOR handled all payroll, social security contributions, and tax filings, ensuring that her business remained fully compliant with Swiss labour laws. Not only did this approach save Anna time and money, but it also allowed her to focus on growing her business rather than exploring complex regulatory requirements.

When is it better to set up a legal entity in Switzerland?

While an EOR offers speed and simplicity, there are situations where establishing a legal entity is the more strategic choice:

- Long-term investment strategy: If your company plans to establish a lasting presence in Switzerland, having a legal entity gives you full control over operations and branding.

- Scaling a large team: For companies planning to hire a substantial number of employees, a local entity provides the infrastructure needed to manage a growing workforce.

- Opening physical offices: A legal entity ensures compliance and control if your company intends to set up brick-and-mortar locations or conduct significant in-country operations.

- In-house compliance capability: Businesses with robust legal and HR departments may prefer to handle compliance responsibilities internally rather than relying on an EOR.

How a Swiss Employer of Record simplifies hiring and compliance

An EOR acts as a turnkey solution for hiring and managing employees in Switzerland, offering numerous advantages:

- Compliance with Swiss employment laws: An EOR drafts legally sound contracts, ensures accurate payroll calculations, and manages social security contributions, keeping you in full compliance with Swiss regulations.

- Simplified payroll and benefits management: The EOR handles monthly salary payments, tax withholding, and employee benefits, removing the administrative burden from your company.

- Reduced risk and cost: By partnering with an EOR, businesses avoid the financial and legal risks associated with establishing a local entity. Instead, they can focus on their core operations while the EOR ensures compliance and efficiency.

- Fast market entry: With an EOR, companies can hire employees in Switzerland within days rather than the weeks or months it can take to set up a legal entity.

Work with the Swiss Employer of Record

The choice between an Employer of Record and a legal entity in Switzerland depends on your company’s strategic goals, budget, and long-term plans. For companies looking for a fast, low-risk entry into the Swiss market, an EOR offers a compliant, cost-effective alternative to setting up a legal entity.

You can determine the best path forward by carefully evaluating your needs and objectives. And if you’re seeking a streamlined, compliant way to hire employees in Switzerland without the complexities of incorporation, contact us to find the solution your business needs.

Contact us

Contact our local expert for tailored guidance on Swiss employment solutions.